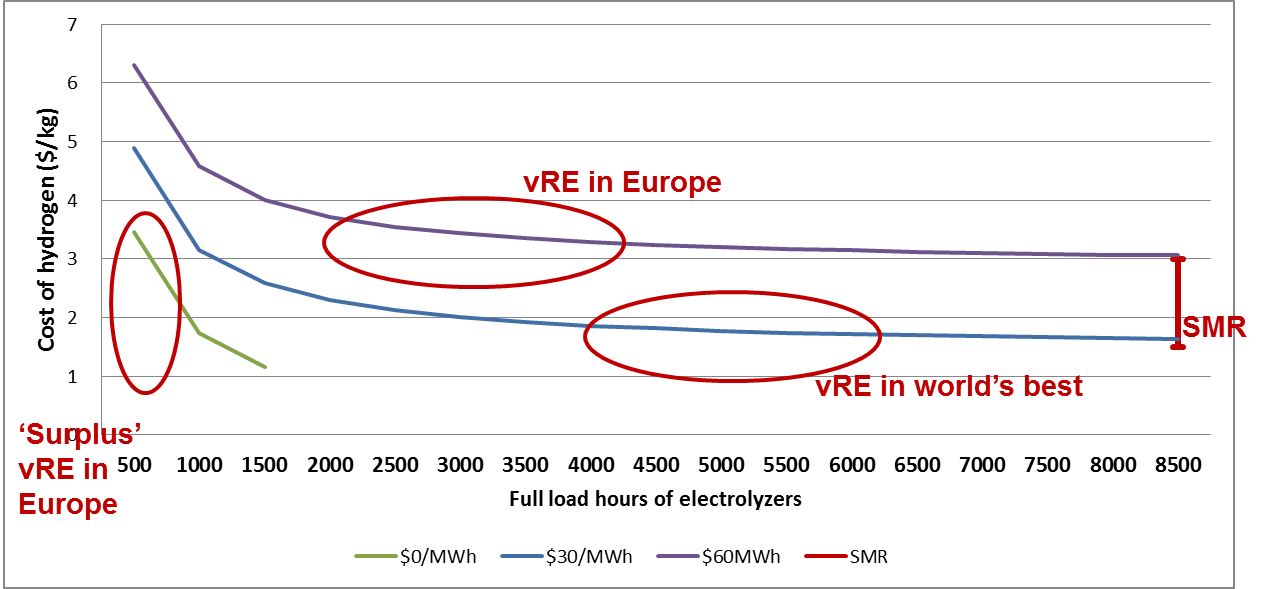

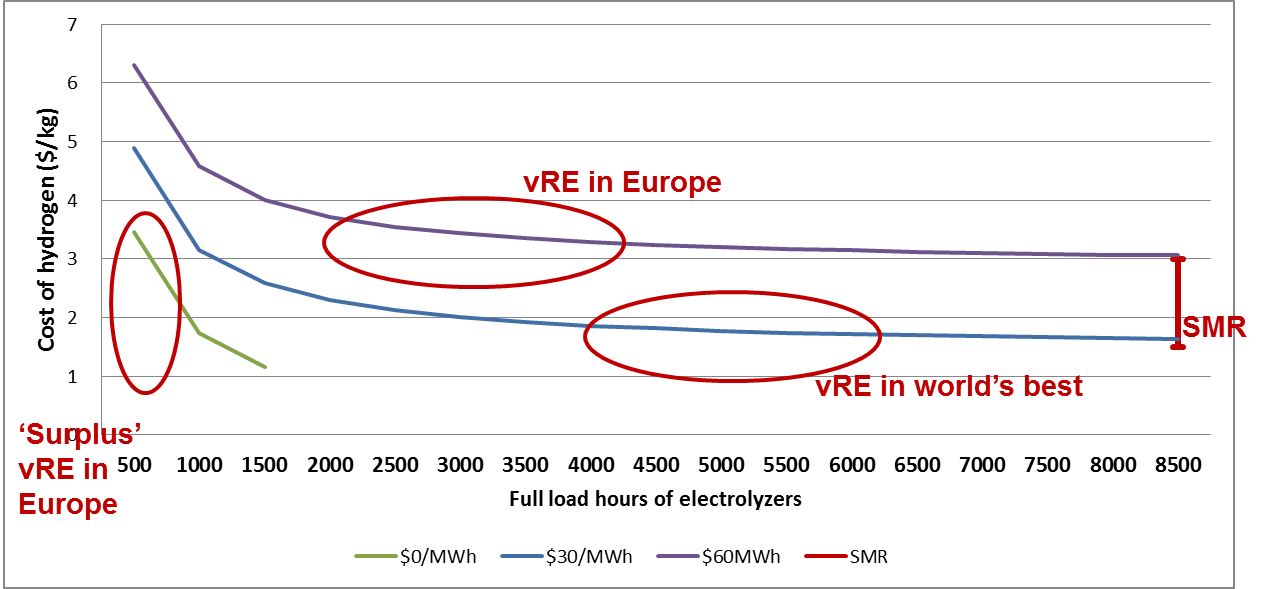

Responding to popular demand, I publish a revised graph showing the cost of hydrogen from electrolysis of water for different load factors, but based on the most recent information about the cost of alkaline electrolysers in large plants, as provided recently by NEL: USD 450/kWh as already mentioned (Note: this graph was again revised on 3 May).

Here you can see three zones: the zone of « free » surplus from solar and wind in Europe (but that would likely apply to Japan as well, and other countries with good but not very good Wind and solar resources); electricity is considered free but the occurrence are relatively unfrequent and I considered 500 to 1500 full load (equivalent) hours a year for the electrolysers; variable renewables in Europe, where solar and Wind combined are unlikely to exceed a capacity factor of about 50%, and the same in most favoured régions of the world.

This leads me to somewhat attenuate my previous prevention against the concept of manufacturing hydrogen from « surplus » variable renewables in countries with average resources. The cost may be found acceptable for some usages, in particular where procurement of other sources of clean hydrogen is not easy. However, it is unclear if some other ways of using this surplus electricity, including as a source of heat, would not prove economically preferable.

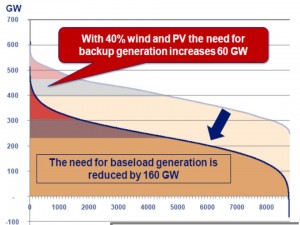

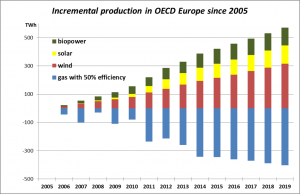

In any case the quantity issue remains: these surpluses will not likely suffice for all current and future, industrial and energetic, uses we have for hydrogen in a climate-friendly energy world. We will need more, much more, and I doubt all could be produced in these regions. Beyond « free » surpluses we would need to deploy many more wind farms and solar farms in addition to those that will be needed to provide the bulk of our grid electricit. And for what? For generating hydrogen at twice its cost in those sunnier and windier areas that have a low population density and very low local electricity demand.

Hydrogen is not easy to transport, and costly to store as a gas, so for most of its usages we would likely bound it to some other atoms to form a variety of energy carriers or fuels, with carbon atoms (methane, methanol, MCH, DME, alcools and hydrocarbons) or without, such as ammonia. And then, transport on land via pipelines, on seas with ships, would be relatively straightforward and represent a small increase in overall cost. Hence importing from best-resource low-demand areas would likely be a very valuable option for complementing local renewable resources in average-resource high-demand areas.

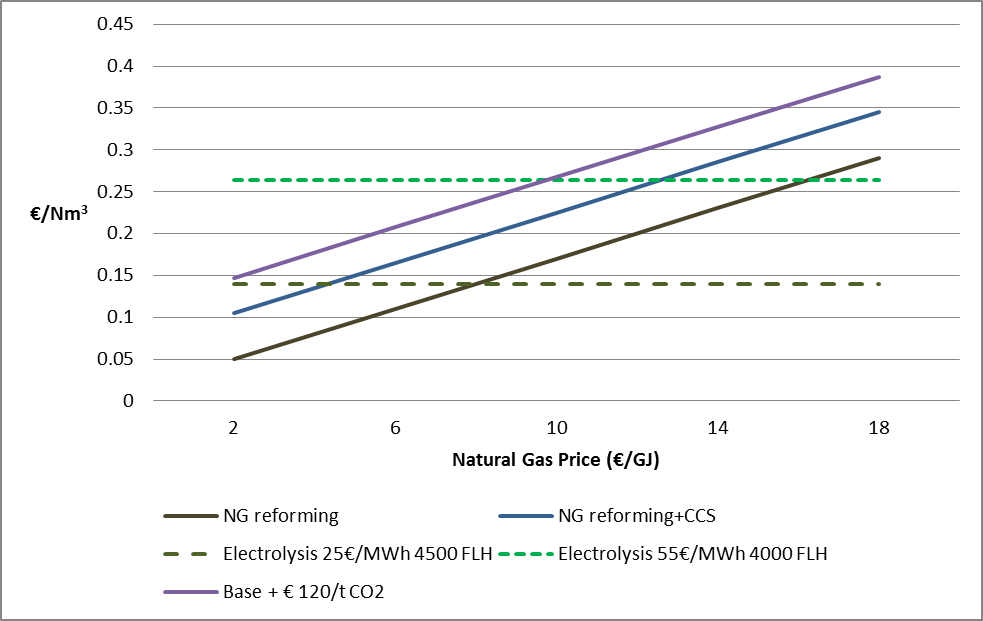

In any case, the economic case for clean hydrogen production vs. fossil fuel based hydrogen manufacturing looks better than previously thought. Except maybe in very cheap natural gas countries, renewable-based ammonia generation and possibly other commodities, including energy carriers, could prove a competitive option from now on, even with no carbon cost or consideration of capture and storage of carbon dioxide.

More on this topic: read my 6-page note on the IEA website, where I explain in particular how a large-scale all-electric ammonia plant could work on variable renewables such as a combination of solar and Wind.

Un vent d’optimisme souffle en ce début juin sur le zoo de Rotterdam, où se réunissent (quoique pour la plupart à distance, pandémie oblige) les adorateurs européens de l’ammoniac, à l’occasion du « NH3 Event 2021 ». Depuis un an, les annonces n’ont cessé de pleuvoir, qui prédisent des productions massives d’ammoniac à partir d’énergies renouvelables. Les partisans de cet « autre hydrogène », verront-ils leurs efforts enfin récompensés ?

Un vent d’optimisme souffle en ce début juin sur le zoo de Rotterdam, où se réunissent (quoique pour la plupart à distance, pandémie oblige) les adorateurs européens de l’ammoniac, à l’occasion du « NH3 Event 2021 ». Depuis un an, les annonces n’ont cessé de pleuvoir, qui prédisent des productions massives d’ammoniac à partir d’énergies renouvelables. Les partisans de cet « autre hydrogène », verront-ils leurs efforts enfin récompensés ?